.jpg)

Arik Air: A Carrier Entangled In Monumental Crises

The crises rocking Arik Air are multi-dimensional and lack a solution. WOLE SHADARE chronicles the problems of the carrier and the futile attempts by its founder, Johnson Arumemi-Ikhide to reclaim his airline

A model at inception

The crisis rocking the erstwhile biggest airline in West and Central Africa, Arik Air, took another turn this penultimate week following the sale of one of its assets – a CRJ 1000 aircraft with registration number 5N-JEE.

Arik at its inception was seen as a model for the airline business in the country. The carrier operated brand new aircraft which was the first after Nigeria Airways. The airline opened so many routes in West Africa, Africa, North America, the Middle East, and London to be specific.

Many organizations in and outside Nigeria recommended the airline to their workers; it soon became the airline of choice among many Nigerians.

Self-destruct button

Gradually, the problems that plagued many airlines before Arik’s entrance began to show up. The carrier operated under huge debts and other influences. It found it extremely difficult to operate its London, Johannesburg, and New York routes. Even domestic operations began to suffer due to debts owed to oil marketers, caterers, and other vendors.

Not a few persons believed that Arik may probably have gone into extinction had Assets Management Corporation of Nigeria (AMCON) not stepped in to rescue the carrier.

The latest imbroglio had to do with a CRJ 1000 aircraft, last flown in 2019 which was sold by its owners – Export Development Canada (EDC) and JEM Leasing Limited – to a foreign buyer, Alberta Aviation Capital Corp, who decided “to tear down the plane”.

Running battle

It will be recalled that the Asset Management Corporation of Nigeria (AMCON), a special debt recovery vehicle of the Federal Government, has been having a running battle operating Arik Air it was placed under receivership in February 2017.

The takeover, according to AMCON, was part of measures to “save” the airline from “imminent collapse”. Six years down the line, it was learnt that Arik remains a hard sell.

Most recently, Arik Air (in receivership) notified the public of “the decision of JEM Leasing Limited owners of the CRJ 1000 aircraft, registered as 5N-JEE, and its financiers, Export Development Canada (EDC), to sell the airplane”.

“We equally wish to notify of the decision of the buyer to tear down the plane. Arik Air, as the lessee since 2014, operated the Aircraft pursuant to a lease agreement with JEM Leasing Limited,” the statement read in part.

It would have been necessary to state the part of JEM’s reaction which had been proven not to be authorized by the airline’s founder.

Bearing no genuine claim to the authorship of the statement, it would be proper not to include it in this write-up unless there is as authentic statement to counter the actions AMCON took as regards the CRJ1000 airplane which is said to be in dispute.

Arik Air’s management sources, however, insisted that the aircraft was sold in line with due process, as the aircraft has since left the operations of Arik and has been deregistered by the Civil Aviation Authority (CAA) in Nigeria since July 19, 2022.

A senior manager said: “The JEM’s claims are not in order. Why would NCAA de-register the airplane, if EDC doesn’t own the aircraft? EDC did deregistration. It’s not even a Nigerian-registered aircraft anymore.

“As far as we are concerned, the Export Development Canada/JEM Leasing has enforced rights on their asset. Arik is just a lessee, and we notified the public because the aircraft has been in our hangar. Arik has not been using the plane since 2019.

It has been a case of back and forth for the two parties with the Economic and Financial Crimes Commission (EFCC) wading into the matter and one that necessitated questioning of Arik Air’s Receiver Manager Mr. Kamilu Omokhide)

EDC warns EFCC

The Export Development Canada (EDC) however warned the EFCC Commission to lay off its Mortgage Rights, the CRJ 1000 which it said the crime commission was obstructing the owner from repossessing following a petition filed by Sir Johnson Arumemi, founder of Arik Air.

The situation has called to question the urgent need by the Nigerian state to protect the interests of international lenders, such as Export Development Canada (EDC), and other potential lenders closely monitoring the ongoing investigations by EFCC into the affairs of the Receiver Manager of Arik, as it relates to the enforcement of mortgage rights by EDC, in respect of a CRJ 1000 aircraft owned by JEM Leasing.

The Receiver Manager of Arik had threatened to sue media houses that published what it termed as a false narrative, saying it is crucial to establish the truth and hold accountable those responsible for disseminating false information.

EDC, as a Crown Corporation wholly owned by the Government of Canada, plays a pivotal role in driving economic growth and development through investments in various projects worldwide.

Discouraging future investment

The EDC is a letter made to Aviation Metric on request and signed by Phillip Hinds for Jems Leasing Limited dated June 5th, 2023 stating that this episode superintended by the EFCC threatens not only future investments by EDC in Nigeria but also sends a discouraging message to other potential lenders considering investments in Nigeria.

According to EDC, “There were numerous, substantial, and continuing defaults (including non-payment of numerous rental amounts due under the Lease) by Arik in the performance of its obligations under the Lease. The Owner granted extensive periods of grace to Arik in order to give Arik the opportunity to remedy those defaults. The defaults were not remedied and, accordingly, on June 20TH, 2022 the owner terminated the leasing of the aircraft under the lease, in accordance with the terms of the Lease. A copy of the notice terminating the leasing of the aircraft under the Lease is appended to this letter.”

“Accordingly, neither Arik nor any person claiming through Arik has any title to, interest in, or right to use or possession of, the aircraft (or any part of the aircraft, including its technical records).

“Pursuant to the termination of the leasing of the Aircraft under the Lease, on July 19th, 2022 the aircraft was de-registered from the registry of the Nigerian Civil Aviation Authority (the NCAA). A copy of the NCAA de-registration notices evidencing such de-registration (and also evidencing the ownership of the aircraft by the owner and the termination of the leasing of the Aircraft to Arik is appended to this letter as appendix 3.

Arumemi-Ikhide fights on

Meanwhile, the founder of Arik Air, Arumemi-Ikhide is throwing everything at his disposal to reclaim his airline but his efforts may have hit the rock.

Arik Air was in 2016 taken over by the Assets Management Corporation of Nigeria (AMCON) over reported N300b debts.

As a first step, John-Ikhide had on May 18, 2022, written a letter to AMCON seeking to recover his airlines taken over from him over huge debts.

But AMCON in its reply dated June 6, 2022, obtained by Aviation Metric entitled, “Re-Proposal For Resolution of Arik Air In Receivership,” with reference AMC/ABJ/SAE/22/552/DTO/49525 welcomed the renewed interest of the major shareholders of Arik Air Limited (In Receivership) for an amicable resolution of the Arik indebtedness.

The letter jointly signed by Head-Enforcement (Specialised Accounts), Faruk Haliru, and Joshua Ikioda (Group Head-Enforcement) for AMCON stated that in situating the resolution thrust, “We wish to advise that the settlement agreement of ref BA/LAG/C/75/11 (attached) dated August 17, 2011, for N70 billion has expired.”

“Similarly, the BOI loan of N21,388, 792,450.41 granted to the company for 8 years from date May 7, 2013, has also expired. Following the terms of the restructuring facility, all concessions ought to be canceled. Based on this, the indebtedness of Arik Air Limited in Receivership is N297,301,356,316.41.”

The assets managers equally stated that to promote the process of amicable resolution, it graciously retained the balances based on the restructuring terms of August 17, 2011for N70bn and the BOI loan of N21,388,792,450.41 dated May 7, 2013.

The outstanding balance based on this according to the firm was N240, 304, 702, 902.84 as of May 26, 2022, including a post-receivership loan of N1.8 billion.

AMCON reiterated its willingness to pursue the amicable resolution of the Arik debt for the sake of the aviation industry and offers its full cooperation.

It however stated that this could only be sustained with good faith cooperation from the shareholders of Arik.

The Corporation constituted a four-man team led by the Group Head-Enforcement (Joshua Ikioda), the Receiver Manager (Omokide, Kamilu A.), the Account Manager (Faruk Haliru), and the Account Officer (Dorcas Olagoke) to actively negotiate a resolution.

AMCON gives conditions to Arik Air’s founder

AMCON maintained that it was willing to table for consideration of its Board and regulatory authorities a settlement with proportionate concessions, stressing that such settlement must be supported by a good faith payment and backed with verifiable proof of funds.

Taking a cursory look into its pre-receivership resolution, the corporation disclosed that it purchased Eligible Bank Assets (Non-Performing Loans) of circa N85 Billion from two Nigerian Banks named Keystone and Union Bank and granted N15 Billion concession/waiver to arrive at a concessionary sum of N70 Billion. This, it said was restructured for a tenor of nine years at a concessionary interest rate of 12%.

Haliru and Ikioda recalled that following various meetings between AMCON and the main shareholders of Arik and given the unwillingness of the Zenith Bank management to deal directly with the said majority shareholder (Sir Johnson), and taking into consideration the systemic importance of the Arik debt, including the need to exercise the controls required to settle, and “your willingness to settle”, AMCON purchased the Eligible Bank Assets of Arik in Zenith Bank. Unfortunately, as feared by the Zenith team, the settlement failed”.

Last line

While Arik Air’s founder wants its airline, AMCON is simply saying pay up your toxic debts amounting to N297 billion and have your airline.

- Tags:

- #Bombay

- #Australiya

- #Canada

Popular Post

-

-

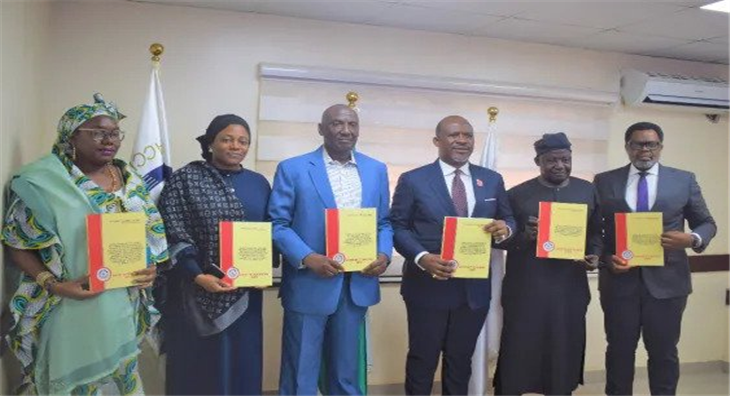

TRAVEL TRADE SHOW

By - Admin

-

-

Indaba short flicks

By - Admin

-

-

WTM Day 1 UPDATE:

By - Admin

-

-

NANTA 48TH AGM :

By - Admin

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpeg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

.jpg)

.png)

.jpg)

.jpg)